CHARACTER : INTEGRITY : TRADITION

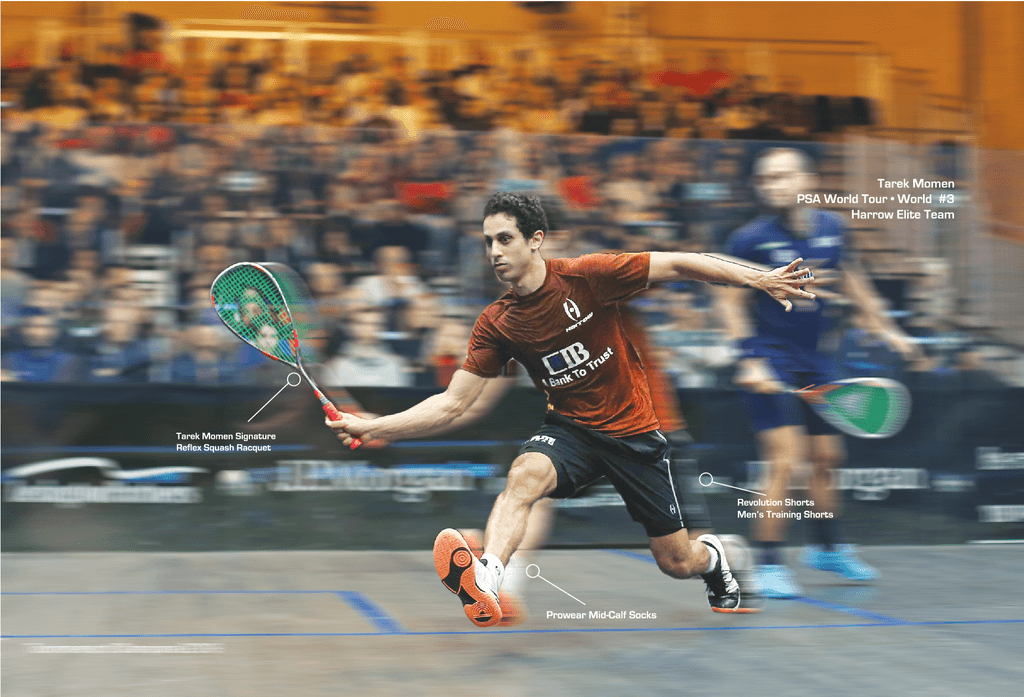

Fundada en el año 2000, Harrow Sports ha revolucionado la industria de las raquetas de squash ofreciendo diseños incomparables, atractivos y en su mayoría personalizados. Después de 20 años en el mercado, aun continuamos expandiendo este concepto que nos hace únicos como marca. Actualmente, apoyamos una serie de deportistas elite que se encuentran en el top de los rankings del deporte.

Nuestros productos

Raquetas

Maletas

Accesorios

-

HARROW JUNIOR RAQUET

$250,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

HARROW EXTREME

$350,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

HARROW CUSTOM TURBO JP

$430,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

HARROW RENEGADE

$590,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

Harrow Vapor Ultralite Squash Racquet

$690,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

HARROW SILK

$590,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

HARROW FURY

$590,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

HARROW STEALTH CAMO

$640,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra)

-

MALETIN SIX RAQUET BAG

$350,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

Muñequeras

$40,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

Rollo encordado calibre 17 – 220 mts

$600,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra) -

Encordado individual calibre 17

$40,000 MAS I.V.A DE 19% (este valor se incluirá al momento de generar la compra)

Nuevos Productos

Compra fácil

Compra segura

Devoluciones sin problemas

¿Cómo comprar una raqueta?

En el mercado de raquetas de squash encontramos varias marcas que ofrecen una serie de referencias que varían entre peso y forma. Un tip o consejo muy importante es fijarse en el peso real total de la raqueta. Lo más común es encontrar raquetas que muestran el peso solo del marco y no de la raqueta encordada y con cinta grip standard, lo cual debería ser lo correcto ya que esto nos informa el peso real total de la raqueta. El video nos muestra un ejemplo.

Últimas noticias

A continuación Puedes ver las noticias destacas del mundo HARROW. Siguenos en nuestras redes sociales